- Autumn Statement 2023 - Property Tax Update

- Elective surgery

- Building a new world

- Budget 2023 - Initial Reaction

- Register of Overseas Entities - Anti-Money Laundering Update

- Autumn Statement – Tax Bonfire! Real Estate & Construction Update

- Is anybody listening?

- Infrastructure Levy (IL)

- Land of confusion? Making sense of the Community Infrastructure Levy

- Who will guard the guards themselves

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- Comedy of errors goes to High Court

- Budget 2021 - Property & Construction Initial Reaction

- Ignorance is No Defence!

- Steadfast Manufacturing & Storage Limited v HMRC – Case Law Update

- "Cash is King" ... Boost Post Coronavirus Cash Flows by Revisiting Historic Property Expenditure

- Jumping the Gun - E³ Consulting comment on Oval Estates Decision [2020] EWHC 457 (Admin)

- When the Levy Breaks… Coronavirus impact on CIL

- 100% ECAs Withdrawn, but Tax Savings Still Available

- Budget 2020 - Reaction

- Postponement of the UK VAT domestic reverse charge

- Edge of Tomorrow - Land remediation tax relief: ten years on

- Mayoral CIL2 Confirmed by Public Examiner

- Sudden Impact!

- Budget 2018 - Reaction

- Tax breaks lessen MEES impact on commercial property landlords

- Budget 2017 key points

- #AS2016 – Real Estate & Construction Update

- An Inspector Calls - Planning Appeal decision

- First Tier Tribunal decision in Susanna Posnett v HMRC

- A Sledge Hammer Approach

- Dodging a Bullet

- Purpose Built Student Accommodation (PBSA)

- Budget 2016 - Reaction

- Reaction to Spending Review & Autumn Statement 2015

- Fistful of Dollars

- Caring for Your Cash Flow – Property Tax

- Reaction to Budget 2015 – Real Estate Tax Update

- Shut the Barn Door

- Pub Conversion Projects – Should I Be Paying Value Added Tax (VAT)?

- The Long & Winding Road: Tax Landscape Evolving

- The Good, the Bad and the Ugly

- Budget 2014 - Reaction

- Adapting to Change - Capital Allowances April 2014

- Autumn Statement 2013

- Are you squeezing all the available tax relief out of your property?

- Investment Property Forum Focus: Spotlight on Tax Planning

- Mist Clears - Autumn Statement

- Fool's Gold

- Real Estate Tax Update

- J D Wetherspoon's Expected Outcome - 'Just & Reasonable'

- Capital Allowances Tax Relief on Restaurants, Bars & Hotels

- E3 Consulting Advises Rose Bowl on Cricket Stadium Development

- Energy Efficiency and Property Tax Savings

Dodging a Bullet - How Solicitors could avoid expensive property tax mistakes

Alun Oliver sets out the real and serious taxation risks thousands of solicitors face on second-hand commercial property transactions - published in Solicitor's Journal in July 2016.

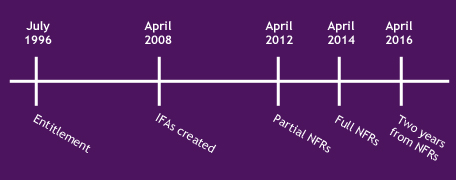

Since April 2014, there have been complex new rules governing the availability of capital allowances on the purchase of existing buildings. Known as the ‘new fixtures rules’ (NFRs), the legislation is contained within sections 187A and 187B of the Capital Allowances Act 2001 (CAA 2001), by virtue of section 43 and Schedule 10 of the Finance Act 2012.

The commercial property standard enquiries (CPSE 1 v3.5) now deal with capital allowances under clause 32 (previously clause 19) and include a request for the contact details of each party’s capital allowances advisers. This alone should be a red flag to those involved (including their advisers) that the matter has become considerably more complex than it was pre-April 2012 and that timely advice from specialists is crucial before the transaction is completed.

Historically, purchasers often left capital allowances until long after the property purchase – or entirely overlooked them. Solicitors typically made passing reference to the capital allowances clause – but rarely provided detailed or comprehensive responses to the questions. ‘Information to follow’, ‘refer to accountant’, or the ubiquitous ‘not applicable’ were the most common replies to CPSEs on capital allowances. Tax is often considered to be out of scope, but cases such as Clarke v Iliffes Booth Bennett [2004] EWHC 1731 and Mehjoo v Harben Barker [2014] EWCA Civ 358 should be uppermost in the minds of advisers in how clearly they define their scope of services and the reliance a client puts on their advice.

This has all changed. Solicitors can no longer afford to avoid the matter. Failure to comply with the ‘pooling requirement’ of section 187A(4) and in turn the ‘fixed value requirement’ in section 187A(6) will lead to the default capital allowances claim for a new purchaser being nil. This now ‘permanent loss’ for the buyer – and all future buyers – is already giving rise to increased litigation and pursuit of negligence cases, so that purchasers can make good the lost tax relief via compensation payments or claims against their solicitor’s professional indemnity insurance.

To date many solicitors have dodged these bullets, mostly by good fortune (in the form of vendor goodwill and co-operation) rather than a thorough working knowledge of the current rules, the specific transaction requirements, or their own practice precedents and risk management policies.

Why are Capital Allowances Important?

Capital allowances are potentially available on all commercial property acquired in the course of a tax-paying business. The qualifying expenditure is offset against the business tax liabilities, income tax for individuals, partnerships, or non-resident landlords, and corporation tax for companies.

Typically, the capital allowances equate to between 10 per cent and 45 per cent of the purchase price of a commercial property, depending upon the age and design of the property, as well as its use. Offices and hotels normally yield capital allowances claims towards the upper end of this range, while industrial and retail are generally towards the lower end; where assets within the tenant fit-out are outside the scope of a landlord’s claim.

Example

Purchase claim of Central London offices yielded just over 25% of the £56m purchase price in capital allowances:

- £4.2m as Plant and Machinery Allowances (PMAs) and

- £10.1m as Integral Feature Allowances (IFAs).

Our claim generated nearly £3m of tax savings for the Non-Resident Landlord.

Reality more complex than theory

One of the key challenges is down to the realities of the UK property market being considerably more complex that the perceived position from government legislators. The NFRs were predicated upon HM Treasury’s expectation that all property owners will have claimed the capital allowances available to them, and, therefore, when they come to sell the property they simply complete an election under section198 CAA 2001 with the purchaser to agree the quantum of allowances to be passed across. Theoretically, that election would be at tax written down value whereby the vendor retains the allowances claimed during their ownership and surrenders the remaining balance for the purchaser to claim.

In reality though, there are countless property investors that have not claimed any of the capital allowances inherent in their properties. Most commonly the vendor might be a non-taxpayer – such as a charity or pension fund – or a property developer (holding the property as trading stock). But even where held by a taxpayer, they may not have claimed their tax relief if they perceived the value to be low, perhaps felt it too complex or that the company had carried forward losses, or had been able to offset their profits due to high interest deductions.

Furthermore, commercial buildings are often bought and sold more than once. Thus, over time, the need to understand the full sequence of ownership and the tax positions of different owners sharply increases the complexity of the capital allowances position. Newly built properties acquired from the developer should allow full capital allowances to be claimed, calculated by reference to section 562, a just and reasonable apportionment of the purchase price paid.

If the vendor has held the property since before April 2008 then the plant and machinery allowances (CPMAs) may be subject to the NFRs limiting the scope of the purchaser’s claim, but the purchaser may also have an unrestricted claim in respect to integral features allowances (IFAs) that had not previously been eligible as PMAs – chiefly general power, certain lighting, and cold water installations. Another variant – to further complicate the picture – is where a previous section 198 election (or section 59B CAA 1990) exists, possibly at only £1 in respect to PMAs.

Here many advisers and clients think there is no further value in capital allowances – yet IFAs may still be available against an unrestricted just apportionment of the purchase price. Such IFA-only claims are typically 3 to 15 per cent of the purchase cost, subject to the design, specification, and use – but often still generate sufficient tax savings to make a claim worthwhile.

Additional complexity can result from refurbishment projects or various tenant fit-outs. All of these layers of capital expenditure need to be properly identified and factored into, or excluded from, any subsequent claims as applicable.

Why now?

The NFRs came fully into force in April 2014 (having had a less onerous transition period between April 2012 and April 2014) and section 187A(11) requires that these must be met within two years of the purchase transaction occurring. Thus up until the beginning of April 2016 (1 April or 6 April for corporation or income tax respectively) there was still time for the parties to try and work out any issues, had they not been adequately dealt with at the time of purchase or through clear contractual obligations for the vendor to co-operate and comply with these convoluted rules.

More and more transactions will now be passing this two-year period, triggering permanent loss of allowances if the parties have not managed to thrash out a claim and election, or otherwise satisfy the pooling and fixed value requirements.

Where the parties can’t agree, section 187A(7) provides for referral of the valuation to the First Tier Tribunal for determination.

The Property Industry Alliance’s (PIA) Property Data Report 2015 valued all commercial property within the UK at £787bn. Considering that up to 40 per cent of the purchase price is potentially attributable to capital allowances it’s easy to start imagining the vast tax savings that could be lost from inadequate advice. Such poor advice could soon lead to significant professional negligence claims by purchasers seeking to compensate for the lost tax savings.

Capital Allowances Timeline

Bulletproofing your Real Estate Solicitors

Further to CPSE 32.10, solicitors would be well advised to take robust advice from a competent and established capital allowances specialist. Sadly, not all ‘specialists’ are and we caution that those seeking a capital allowances adviser look to long-established firms that have not only an appropriate level of professional indemnity insurance but also professionally qualified staff.

As with stamp duty land tax and business rates, there are some so-called ‘capital allowances consultants’ that are more akin to snake oil salesmen.

As a result of this complex legislation, it is vital that capital allowances are addressed early on, ideally by the vendor before their agents prepare marketing particulars or draft heads of terms. If the commercial imperatives of the transaction result in little time to prepare or comply with the NFRs before the sale, then it is essential that the sale and purchase agreement properly considers the respective obligations of each party to co-operate after exchange and completion.

We regularly see default contract wording that normally only sets out that the parties will enter into a section 198 election – in all cases – even when not relevant or possible. Too often these elections are also poorly drafted and not compliant with section 201 CAA 2001, which requires:

- The amount fixed by the election;

- Names of parties making election;

- Information sufficient to identify PMAs or IFAs;

- Information sufficient to identify the relevant land;

- Particulars of the land interest freehold (s.198) or lease granted (s.199); and

- Tax references and relevant HMRC contact details for each party

Example

The seller’s solicitors were trying to insist that our client accept a £1 election under s.198 when the vendor was a property developer and had confirmed in the CPSEs that the offices were newly built and held as trading stock! Had our private investor client not taken specialist advice they would have lost over £40,000 of tax relief – just because the vendor’s solicitor wanted to recycle their ‘practice standard’ rather than adjust the contract wording for this specific transaction.

Luckily our client’s solicitor was sufficiently diligent to recognise they needed specialist support.

Think ahead, treat each transaction separately, ensure the contract wording is appropriately unique to the situation and parties, stay within their professional and technical abilities, and where necessary bring in additional professionally qualified specialist advisers.

If a past transaction has not yet reached the two-year time limit and the capital allowances are £100,000 or more, it might not be too late to revisit.

Early consideration and good contract drafting is clearly the preferred method of protecting your clients’ tax position as well as minimising practice risk. Where this may not have been done don’t sweep it under the rug. Dealing with it head on could bring it to a timely and tax-efficient conclusion. Be warned that late, post-contract negotiations rarely operate on goodwill alone and increasingly we are seeing vendors demanding payment of a significant proportion of the available tax savings to co-operate with the NFRs.

This article was published in Solicitor's Journal in July 2016.

To Read The Full Article download the PDF in the right side panel

Share this page

Document downloads

-

- Dodging a Bullet

- Dodging a Bullet

- pdf (464.12kb)

RSS

- This page can be found in the following news feeds:

- E3 Consulting News