- Planning Enforcement Changes to take effect from 25 April 2024 - LURA2023

- Finalist in 2024 Taxation Awards

- Spring Budget 2024

- Deadline looming for registration of Scottish property owners

- Nowhere to hide for Furnished Holiday Let owners

- 100% Full Expensing made permanent

- RICS CIL Index 2024 Announcement

- SPA Clay Shoot 2023

- We are exhibiting at UKREiiF 2023

- Welsh Freeports - The two winning bids are...

- Chancellor announces Full Expensing

- 100% Tax relief confirmed for two Scottish Green Freeports

- Making Your Furnished Holiday Lettings More Profitable

- Happy New Year 2023

- Second U-Turn in Urenco Chemplants Case – Court of Appeal Decision

- How Specialists help to Save through Property Tax

- E3 Consulting on the move in London

- Autumn Statement (November): impact on capital allowances

- December Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- E3 goes to top with calls for planning re-think

- The Chancellor’s ‘Mini Budget’ – A Tax Bonfire!

- HM Queen Elizabeth II

- Gardiner v Hertsmere - Court of Appeal Judgment

- E3 Consulting's new main office in Wimborne

- Green light for Freeports

- Buried treasure?

- And the winner is...

- Cavernous divide in ‘plant’ arguments

- And the finalists are…

- E3 Consulting puts property tax on the radar

- Help E3 Consulting grow in a nurturing environment

- Spring Statement 2022 – Real Estate & Construction Update

- E3 joins the dots with Building People

- Property Marketing Awards 2022 – Celebrating 30 years of PMA

- Navigating choppy waters

- E3 helps GPs go green with trailblazing surgery

- CIL – New Research Lays Bare Planning Cost

- Webinar success as spotlight shines on Super-deduction

- CIL appeal win saves householder £22,000

- Business Analyst Flo joins E³

- Budget Day Autumn 2021

- Firing on all cylinders

- LRTR Boost your Tax Savings & Unlocking Toxic Land

- CIL by Numbers!

- Shining the legal spotlight on capital allowances

- UPDATE: 130% Super-deduction to be available for landlords

- Specialist speakers announced for CIL webinar panel discussion

- Happy 18th birthday…to us!

- Land remediation myths cleared up at conference

- E³ Consulting – 18th anniversary

- Tax Day 23 March 2021 … over hyped & under whelming!

- Super-deduction…super insight from E³ Consulting’s webinar

- Budget 2021 – Update – Super Deduction

- Budget 2021 Update – Significant tax breaks for freeports announced

- Budget – 2021 – Small Profit Corporation Tax Rate

- UK FREEPORTS - Will Tax Incentives Fulfil Their Purpose?

- E³ Consulting Support Minstead Trust’s Online Christmas Raffle

- E³ Consulting’s Autumn Property Tax Webinars

- £1m AIA Extension

- Alun Oliver becomes CEDR Accredited Mediator

- Property & Construction Update

- Community Infrastructure Levy (CIL) - New Year, new rules!

- Budget 2020 - Wish list for Eco friendly Buildings

- Todd Arnison joins YEP Southampton committee

- Welcome to our Winter update!

- RICS Community Infrastructure Levy Talks

- University Award for Apprentice Todd

- Toasting a Record Year for E3 Consulting

- It was 'Not Too Taxing' for the E3 Team at the SPA Clay Shoot

- Finalist in 2019 Accounting Excellence Awards - Specialist Team of the Year

- Finalist in 2019 Taxation Awards - Best Independent Tax Consultancy Firm

- Celebrating 15 Years in Style

- Consulting Boutiques: A Different Perspective on Consulting

- Studying Modern Languages: what skills do you gain and how are these relevant in work?

- It's all in the Mind

- Capital allowance changes consultation

- International Invasive Weed Conference

- Significant tax savings illuminated at London landmark

- So close for Todd in national award

- Taxing matters for property sector - Seminar 17 October 2018

- National award shortlist for apprentice Todd

- Three top tips for organising a fundraising event - and how these are relevant in business

- Alun takes seat on CLA regional board

- E3's Tax Trappers at it again at the SPA Clay Shoot

- Property Tax Update at Athelhampton House

- Welcome to our New Property Tax Surveyor

- Success at the JCI UK National Convention 2017

- RICS Q3 Market Survey Update

- Defeat for Taylor Wimpey on Builder's Block VAT Claim

- Non-Resident Landlords (NRL) to move into Corporation Tax Regime

- Joining JCI Southampton as a Corporate Partner

- Signatory to the RICS Inclusive Employer Quality Mark

- E3 Consulting Sponsors Hampshire Hot Shots!

- S.O.S.! Tackling the Housing Crisis, CIL and Build to Rent

- International Women's Day: Making a Commitment to Diversity and Equal Opportunities

- CPD Property Tax Talks

- Why E3 Consulting Employers Interns

- Re-joining the Dorset Chamber of Commerce & Industry

- Post Brexit View: Improvise, Adapt and Overcome!

- Welcoming New Interns to E3's Team

- Sponsorship of Alresford Town Football Club

- Finalist in 2015 Taxation Awards - Tax Consultancy Firm

- University of Warwick's Proactive Support of SME Businesses

- Property Taxation Specialist - Finalist in 2014 Taxation Awards

- VAT Specialist, Martin Scammell, Wins Indirect Tax Award

- Capital allowances claims using sampling for fixtures: HMRC Brief

- Deadline for VAT Relief on Listed Buildings

- Business Property Relief on FHLs

- Victory in the 9th annual Solent Property Tennis Tournament

- Industry Response to HMRC's Capital Allowances proposals

- Winning Partnership with Rose Bowl Plc

- E3 Consulting Wins at Taxation Awards 2011

- E3 Consulting Shortlisted for Lexis Nexis Taxation Awards 2011

- Change of VAT Rate

- Property Taxation Planning Opportunities - November 2010

- E3 Consulting Crowned Mixed Doubles Tennis Champions!

Budget 2020 - Wish list for Eco friendly Buildings

Most tax commentators were surprised by the abolition of the 100% Enhanced Capital Allowances (ECAs) announced in October 2018 and taking effect from the end of March 2020 for corporation tax and 05 April 2020 for income tax.

Most tax commentators were surprised by the abolition of the 100% Enhanced Capital Allowances (ECAs) announced in October 2018 and taking effect from the end of March 2020 for corporation tax and 05 April 2020 for income tax. ECAs were available against specific ‘green’ assets that provided exceptional (and validated by Carbon Trust) energy or water savings. These accelerated capital allowances were seen as a ‘carrot’ to offset the ‘stick’ aspects brought to bear on property owners by MEES Regulations requiring EPC ratings to be improved to at least a category E or better, otherwise building leases could not be granted and for existing leases, no further extensions would be possible if the rating is not achieved before April 2023 (for commercial properties). However, HM Treasury/HM Revenue & Customs (HMRC) felt the new SBAs on the balance of new construction expenditure (incurred on or after 29 October 2018) would negate the benefit of the ECAs at 100% relief.

Within the Conservative Party Manifesto there was an undertaking to boost the SBAs rate from 2% per annum for 50 years to 3% p.a. – albeit 3% into 100% is more complicated - and thus an obvious choice would be 4% for 25 years – effectively replacing the former Industrial Building Allowances abolished by Gordon Brown in 2008 and phase out by 2011.

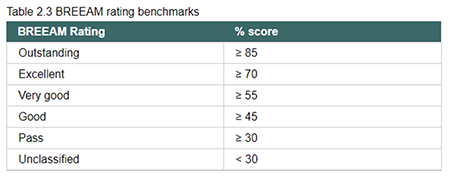

Whilst HM Treasury, HMRC and the Carbon Trust have been at pains to stress the on-going intention to retain the Energy & Water Technology Lists we have lobbied for an updated version of ECAs or ‘boosted’ SBAs where clear energy or water efficiency targets are achieved. Of these we believe the simplest might be to tie the tax breaks into the existing BREEAM rating benchmarks. Thus those new build projects currently eligible for 2% SBAs over 50 years could be boosted as follows:

- 50% SBAs over 2 years - for buildings achieving the very highest rating of ‘Outstanding'

- 25% SBAs over 4 years - for buildings rated as 'Excellent' and;

- 10% SBAs over 10 years - for buildings rated ‘Very Good’.

The lower categories, ‘Good’ and below, would remain at the normal default SBA rate – currently 2% over 50 years. According to BRE (Building Research Establishment) only the top 1% of new builds achieve the 'outstanding' level, and so the cost to the Exchequer would be minimal, whilst incentivising those that do achieve these higher energy efficient ratings to see a return on their environmental design efforts.

Table 2.3 BREEAM rating benchmarks

We urge the Government to reinstate a clear tax based incentive for property owners to pursue ever improving environmental leadership as the Country seeks to achieve NetZero at the earliest opportunity, rather than by 2050, ensuring we can also help lead the world to be more responsible in properly considering the environmental consequences of our actions.

Lastly in an effort to achieve greater housing delivery we would further ask the Government to consider extending availability of SBAs to the ‘Build to Rent’ (BTR) sector. Whilst we recognise HMRC does not wish to ‘open the flood gates’ on residential properties achieving tax relief; private residences, Assured Shorthold Tenancies and Homes of Multiple Occupation (HMOs) could be readily EXCLUDED from tax relief, yet large scale BTR projects with say, more than 25units per block/building, could become eligible for SBAs at the standard rate – subject to their individual BREEAM ratings achieved and the above boosted SBAs for the most environmental designs.

Budget day remains 11 March 2020 and we await Rishi Sunak’s first budget to see if a forward looking and brave Budget can really unleash the county’s potential – or simply perpetuate stifled and retro-thinking tax measures that fail to consider modern business structures and hope to proactively deliver housing growth?

If you wish to understand further how these changes could impact you and your business, please do get in touch.

Share this page

RSS

- This page can be found in the following news feeds:

- E3 Consulting News