-

-

- Capital Allowances

- Every property sector can benefit from Capital Allowances, even certain residential schemes. With E3 Consulting's expert guidance, significant savings can be made.

-

.jpg)

- Accelerated Allowances

- Accelerated allowances allow taxpayers to claim up to 130% of the capital allowances relief in the year of expenditure.

-

- Land Remediation Tax Relief

- Land Remediation Tax Relief can generate significant savings on regeneration projects involving contaminated or derelict sites for property owners, investors and developers.

-

-

-

- Structures and Buildings Allowances

- Structures and Buildings Allowances (SBAs) are given as a straight line relief on eligible construction costs incurred for new non-residential structures and buildings.

-

- Value Added Tax (VAT)

- VAT is collected on business transactions, inputs and acquisitions. E3 Consulting can help identify savings on VAT which are often missed.

-

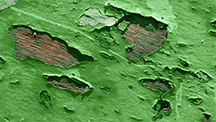

- Repairs and Maintenance

- Straightforward repairs or 'like for like' replacements are an allowable revenue expense deduction at 100% from taxable profits in the same year.

-

-

-

- Community Infrastructure Levy (CIL)

- The Community Infrastructure Levy is a levy charged against the applicable land owner or developer and must be paid to the local council - in respect of new planning permission for development, granted after CIL came into effect for the LPA.

-

- E3 Seminars & Workshops

- We offer tailored seminars or smaller interactive workshops to clients and prospective clients; as well as property, law and tax professionals. Explaining how property tax savings can be optimised - in this highly technical area of property taxation, reliefs & fiscal incentives.

-

- Dispute Resolution

- Our team has a proven track record in dealing with HMRC enquiries, providing advisory services and acting as Technical Expert or Expert Witness in relation to property tax matters.

-

Our Services

Many taxpayers are missing out on significant tax savings in their property expenditure. Below are the most common areas we identify savings for our clients