- Property Tax Breakfast

- E3 Consulting Conferences 2025

-

Past Events

- RTPI South West - CPD Day

- ‘Developer Roundtable’ event at Silvermere Golf & Leisure, Cobham, Surrey

- BPA Post Autumn Budget Panel Seminar

- Property Tax Roundtable - CIL, LRTR & Budget Update

- December Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- November Roundtable - Community Infrastructure Levy & Land Remediation Tax Relief

- Commercial Property purchases – is tax relief on your radar?

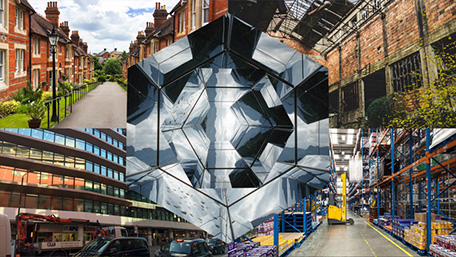

- A kaleidoscope of property tax opportunities

- Webinar: CIL Panel Discussion

- Minerals conference left no stone unturned

- Webinar: Super-deduction…130% Tax relief, but Super Complicated!

- CIL Property Tax Webinar

- CA Property Tax Webinar

- RICS Community Infrastructure Levy Talk - Stratford Upon Avon

- Portsmouth University CPD - Construction and Property Taxation

- RICS Community Infrastructure Levy Talk - Manchester

- RICS Community Infrastructure Levy Talk - London

- RICS Community Infrastructure Levy Talk - Ipswich

- Portsmouth University CPD - Construction and Property Taxation

- Property Taxation Breakfast Update

- RICS CPD Day, Cardiff

- RICS CPD Day, London

- RICS CPD Day, Exeter

- CIOT/ATT - Reading – Property Tax Seminar

- RICS CPD Day, Southampton

- CIOT/ATT - Leeds – Property Tax Seminar

- CIOT/ATT – Sheffield – Property Tax Seminar

- Property Taxation Lunch Update

- CIOT - Scottish Borders - Rural Day Conference

- Capital Allowances & CIL, Land Remediation Update - Wimborne

- CIOT - Thames Valley: Optimising Tax Savings

- Capital Allowances & CIL, Land Remediation Update - Dorchester

- Summer Breakfast Seminar

- VAT & Capital Allowances Lunch Seminar

- Business Networking Lunch

- London Property Tax and Tax Policy Update - 11th June 2014

- E3 Property Tax Update Series - Southampton

- MIPIM in Cannes - March 2010

- Rose Bowl Property Tax Seminar - 22nd June 2009

- E3 Consulting Sponsor Hampshire Golf Day - 7th May 2010

- Bournemouth Hotel and Catering Show - 10th March 2009

- Bournemouth Care Show Seminar - April 2008

- Property Taxation Breakfast Seminars - 2006

- E3 Consulting Sponsor Purbeck Film Festival - October 2007

- CIOT - East Midlands: Property - Capital Allowances and SDLT

- CIOT/ATT - Newcastle - Property Tax Seminar

- Property Taxation Update - Dorchester

- RICS CPD Day, Bristol

- VAT & Capital Allowances Update: The Reality

- What's Changed in the World of Property Tax?

- Risk Management & Property Tax

- Portsmouth University CPD - Commercial Property Taxation

- RICS CPD Day, Leeds

- Capital Allowances Seminar – The New Fixtures Rules - 22 March 2013

- CIOT/ATT - Oxford – Property Tax Seminar

- CPD Essentials: Quantity Surveyors Training Day - 14th November 2012

- LexisNexis webinar - 'Making the most of Capital Allowances' - 29th November 2011

- RICS Property Seminar - 15th March 2011

- Salisbury Property Taxation Seminar - 4th November 2010

- RICS Seminar - VAT on Listed Buildings - November 2010

- SPA Seminar - 30th September 2010

- E3 Charity Quiz Night and Curry - 16th April 2010

- Dorchester Property Tax Seminar - 24th November 2009

A kaleidoscope of property tax opportunities – the ‘Super-deduction’ in full colour

Save the date – Thursday November 11 at 1:30 p.m. – when the Super-deduction will come into sharp focus at our next webinar.

Our Managing Director Alun Oliver FRICS and Property Tax Surveyor Todd Arnison hosted the live event online about this allowance introduced in early 2021 – including subsequent changes which now benefit landlords and property investors.

They gave insights into how money can be saved via the super deduction and illuminated the opportunities to capitalise on the benefits it offers.

Here’s a brief profile of what was covered in the Super-deduction webinar:

Background

The Super-deduction was announced in the Budget in March 2021 and then included in the Finance Act 2021 with Royal Assent on 10 June 2021.

It gives corporation tax payers the chance to claim a 130 per cent capital allowance on expenditure qualifying as plant and machinery in what the tax legislation references as the ‘Main Pool’ or 50 per cent special rate allowance in respect to asset expenditure allocated to the ‘Special Rate pool’ for integral features, thermal insulation or long-life assets on new expenditure from April 1 2021 to the end of March 2023.

What’s changed

Initially, the allowances were not available to property investors due to a wide-ranging restriction for leasing activities, including property letting; but following sustained industry lobbying, the Government relented and has allowed qualifying expenditure in leased buildings to qualify for these accelerated allowances.

Our webinar

Our webinar was on Thursday November 11 at 1:30 p.m. covered the Super-deduction context, the rules and process as well as illustrated the opportunities on offer.

Who benefitted from attending

It was of value to owner-occupiers, landlords & tenants, investors, chartered surveyors, accountants, solicitors, and other property professionals.

Why did people attend

The very welcome changes for landlords and investors creates an exciting spectrum of opportunities beyond the very clear financial benefits and money to be saved.

It should play a role for those with expected future asset investment in cash flow forecasting and enable more flexibility in a strategic approach to investment whether that means advancing project timescales to bring schemes forward or launch concurrent or new projects.

It may allow higher specification for existing and new projects or even help to fund investment in business growth, new employees and/or training and development of staff.

The webinar provided a better understanding about the Super-deduction and wider kaleidoscope of capital allowances, as well as clarify the processes involved and qualifying criteria for claiming these useful tax savings.

There was valuable insights and case studies to give colour and illustrate best practice, compliance, project risk management, savings optimisation and cash flow enhancement.

Please do get in touch with any questions or enquiries by telephone on 0345 230 6450 or by email on hello@e3consulting.co.uk

Share this page

RSS

- This page can be found in the following news feeds:

- E3 Consulting News

Speakers

Alun Oliver FRICS

Todd Arnison