Accelerated Allowances

Accelerated allowances allow taxpayers to claim up to 130% of the capital allowances relief in the year of expenditure.

Writing Down Allowances

Usually capital allowances are claimed over multiple tax periods by reference to a per annum rate, allowing the taxpayer to ‘write off’ a certain percentage of their claim each year, known as the Writing Down Allowance (WDA).

Each ‘pool’ has its own WDA rate, currently set at 18% per annum for the Main Pool (Plant & Machinery) and 6% per annum for the Special Rate Pool (Integral Features).

Accelerated allowances enable the default rates, as above, to be boosted, sometimes specifically for certain assets or particular periods, or as otherwise designated by the tax legislation. Accelerating the relief should significantly improve the cash flow benefit to the taxpayer. The current accelerated allowance details set out below.

Annual Investment Allowance

Introduced in April 2008, the Annual Investment Allowance (AIA) allows the taxpayer to accelerate the relief of their capital allowances claim in a period to 100%, rather than the standard WDA rates, up to a capped level of allowances. Since its introduction, the AIA limit has been regularly changed, ranging between £25,000 and £1,000,000.

Currently AIAs, effective since January 2019, are available on first £1,000,000 of qualifying expenditure – this limit was due to revert back down to the preceding rate of £200,000 on 01 January 2021, however this was extended late in 2020 for a further year until 31 December 2021, and again at the Autumn 2021 Budget announcement until 31 March 2023, before being made permanent in the Autumn Statement 2022. This means that any claim up to £1m in a current accounting period may be accelerated to 100%, with any ‘excess’ allowances above this threshold given at the applicable standard WDA rates, as above.

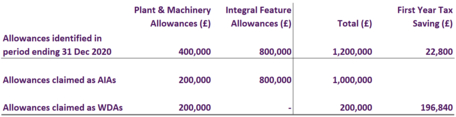

If a taxpayer has a claim for any period exceeding the AIA cap for that year, careful consideration must be taken to ensure the most beneficial allocation of the allowances to preserve the best cash flow. When exceeding the AIA cap the allowances revert to their ‘normal’ WDA rate, meaning that it is most efficient to allocate those assets identified as Integral Features to the AIAs, as these are given at the lower rate of 6% per annum, rather than 18% (Plant & Machinery).

Example:

*Based on 19% Corporation Tax rate.

Furthermore, there are restrictions on AIAs that do not allow expenditure qualifying for the Structures and Buildings Allowance (SBA) to be claimed under these accelerated AIAs. As well as rules regarding ‘dirty’ partnerships – those with a mix of individual and corporate entities – that prohibit them from claiming AIAs.

First Year Allowances

Since the introduction of the Capital Allowances Act 2001, a number of different categories of assets have qualified for First Year Allowances (FYAs). These FYAs allow the taxpayer to claim a boosted level of relief in the initial tax period during which the expenditure was incurred, rather than the default WDAs.

The most notable FYA in operation currently is the 100% Full Expensing (FE), announced during the Budget Statement 2023 as the measure to take over following the repeal of the 130% Super-deduction, for expenditure incurred on or after 01 April 2023. FE allows companies investing in qualifying new plant and machinery assets to claim the full 100% deduction (against corporation tax) on main pool assets in the year of expenditure, with corresponding 50% deduction for special rate pool assets. The measure was originally only put in place for three years, however, during the Autumn Statement 2023, the Chancellor announced that Full Expensing would be made permanent. FE is not available to claim against income tax.

Taxpayers may still be eligible to claim the 130% Super-deduction, in operation between 01 April 2021 and 31 March 2023, where open accounting periods include qualifying expenditure in part or all of the operational period. However, the clock is now ticking to make use of this boosted tax relief, as entitled taxpayers only have their normal two-year tax window to claim the available relief. The Super-deduction is available only on new plant and machinery, at a 130% deduction on main pool, but for special rate pool assets reduced to 50% FYAs, known as ‘SR Allowance’. There are notable restrictions on this FYA, including but not limited to, exclusions for contracts entered into before 03 March 2021.

Enhanced Capital Allowances were available at 100% for specific energy or water efficient assets/technology from 2001 and withdrawn in April 2020.

Expenditure on electric vehicle charging equipment has qualified as FYAs since their introduction under s.38 Finance Act (No2) 2017 with effect from 23 November 2017. Again, these allowances were originally due to expire in April 2019 and 2023, however they have been extended twice and so will continue to attract 100% FYAs until 31 March/05 April 2025, for Corporation Tax and Income Tax respectively.

It is important to ensure that all of the expenditure has been fully analysed, as items such as new or improved electrical infrastructure incidental to the installation of the charging equipment may also qualify for the increased 100% FYA.

This page highlights the main property and construction areas of accelerated capital allowances but there are other types of FYAs available on a number of other specific trades or assets. For more information on any aspects, or to ‘model’ the cash flow impact of these various FYAs/AIAs, please do contact us as below.

Contact Us

For more information call a member of our team on 0345 230 6450 or by completing the adjacent enquiry form for a no obligation, no fee initial discussion.

From our experience you’ll most likely be surprised at the level of tax savings that can be achieved.

Share this page

Related Pages

Related Articles

- 100% Full Expensing made permanent

- Chancellor announces Full Expensing

- UPDATE: 130% Super-deduction to be available for landlords

- Super-deduction…super insight from E³ Consulting’s webinar

- Budget 2021 – Update – Super Deduction

- Budget 2021 Update – Significant tax breaks for freeports announced

- £1m AIA Extension

- Budget 2018 - Reaction

.jpg)